Mission,Vision, and Core Values Statements

Mission

Serve in the highest regard by providing a fair and equitable valuation of all taxable property in Maricopa County without favor or partiality while efficiently and effectively administering applicable laws and industry standards.

Vision

Be a best-in-class organization that is recognized for its accuracy, transparency, innovative solutions, and high value services.

Core Values

Fair & Equitable Service

Always do what is right; be honest, accurate, and transparent with property owners, the public, and our team about our work and how it is performed. Ensure fair and equitable property valuations to support the collection of property taxes that are essential funding for valuable community resources.

One Team

Work as a collaborative team with civility, respect, and compassion. Be hard-working, dedicated, and best-in-class public servants while conducting all business to the highest quality and providing a superior customer experience.

Innovation & Efficiency

Implement practical and effective solutions that improve our workflow, processes, and the lives of our team members and the public we serve.

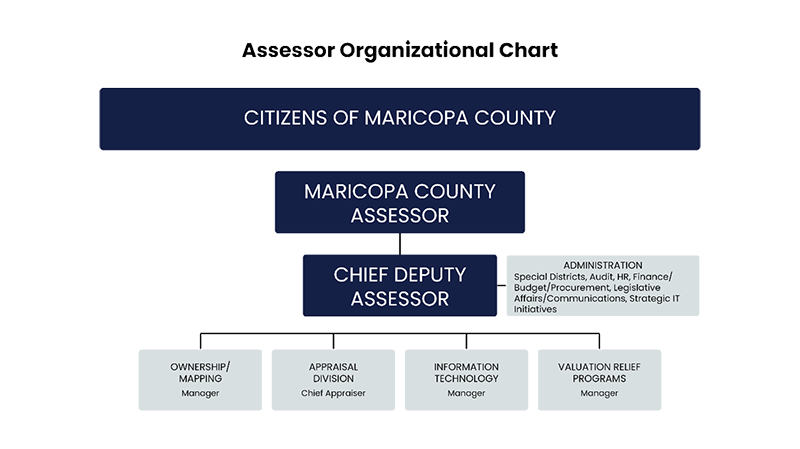

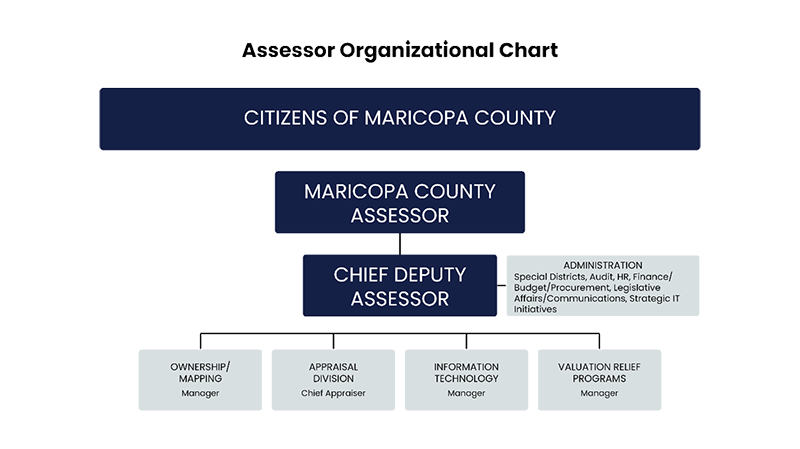

Assessor Organizational Chart

Assessor's Office Divisions

The Assessor's Office is composed of five divisions; the Administrative Division, the Valuation Relief Program Division, the Information Technology Division, the Property Ownership & Mapping Division, and the Appraisal Division.

The Administrative Division provides the leadership and strategic vision to support the employees of the department so they can achieve their departmental missions. This includes human resource activity, procurement, budget, data sales, legislative bill tracking, intergovernmental communication, and special districts.

The Valuation Relief Program Division consists of three units; 1) Personal Exemptions: Directs and monitors the Senior Valuation Protection Program, along with the Widow/Widowers, and Disability property exemption programs to ensure compliance with Arizona State law. 2) Organizational Exemptions: Directs and monitors all historic, religious, government, and other commercial property exemptions to ensure compliance with Arizona State law. 3) Public Assistance: Provides outstanding customer service and assistance to our constituents.

The Information Technology Division, in cooperation with Maricopa County's Office of Enterprise Technology, manages all aspects of the computing environment for the Assessor's office including application development and support, business analysis, database management, data center operations, system administration, desktop support, and our web presence for public-facing services. The division also develops and supports GIS systems and applications that manage spatial data for the Assessor's Office and other entities allowing them to analyze geospatial information. Lastly, the division operationally “houses” the new Maricopa Assessment Replacement System (MARS) team and includes experienced appraisal staff dedicated to the evaluation of emerging technologies.

The Property Ownership & Mapping Division is responsible for updating all property ownership and title information (real & personal) through various reporting entities and the maintenance of the County's parcel fabric layer in a geospatial environment. The division also creates customized maps and provides continual customer service.

The Appraisal Division is responsible for discovering, listing, and valuing residential, commercial, agricultural real estate and personal property, as well as vacant land within the County. The different functions have been grouped into three geographic units (North, East, and West) within this division. The focus is on consistency, efficiency, and stronger communication within the appraisal functions in order to better serve our customers. The valuation process includes a mass appraisal methodology used to create valuation models for various property types. These valuation models are developed in accordance with the Arizona Department of Revenue standards for mass appraisal compliance. The valuation models are used to accurately and efficiently determine property values throughout the County. This includes reviewing all permits, addressing splits, recheck requests, and notice of claims as well as canvassing and agricultural applications. The goal of developing a canvassing program is so the office can actually review every property within a consistent cycle to ensure we have accurate data information. We provide property characteristics and valuation information to external and internal customers, ensuring compliance with Arizona State laws. The division also ensures that exempt properties are accurately listed and maintained on the property roll. The Appraisal Division also handles administrative appeals regarding assessments of both real property and personal property and provides all support to the County Attorney and Board of Supervisors to arrive at valuation and classification decisions that have been appealed to the Judicial Branch of government for resolution. The Appraisal Division also oversees Business Personal Property BPP which handles the review and verification of the personal property associated with the commercial businesses and the mobile/manufactured home industry. The business owners are required to file updated inventory forms annually. They are reviewed and in some cases are audited. The BPP audit and internal audit groups provide the County Assessor with an independent consulting and investigative function to examine, evaluate, inspect, critique and report assessor activities.